Unveiling the Potential of Bitcoin: My Personal Odyssey into the Future of Finance

Bitcoin is a digital currency that was established in 2009 by an individual or group under the alias Satoshi Nakamoto.

It is decentralized, functioning on a peer-to-peer basis, which enables users to carry out transactions directly without the necessity of a middleman.

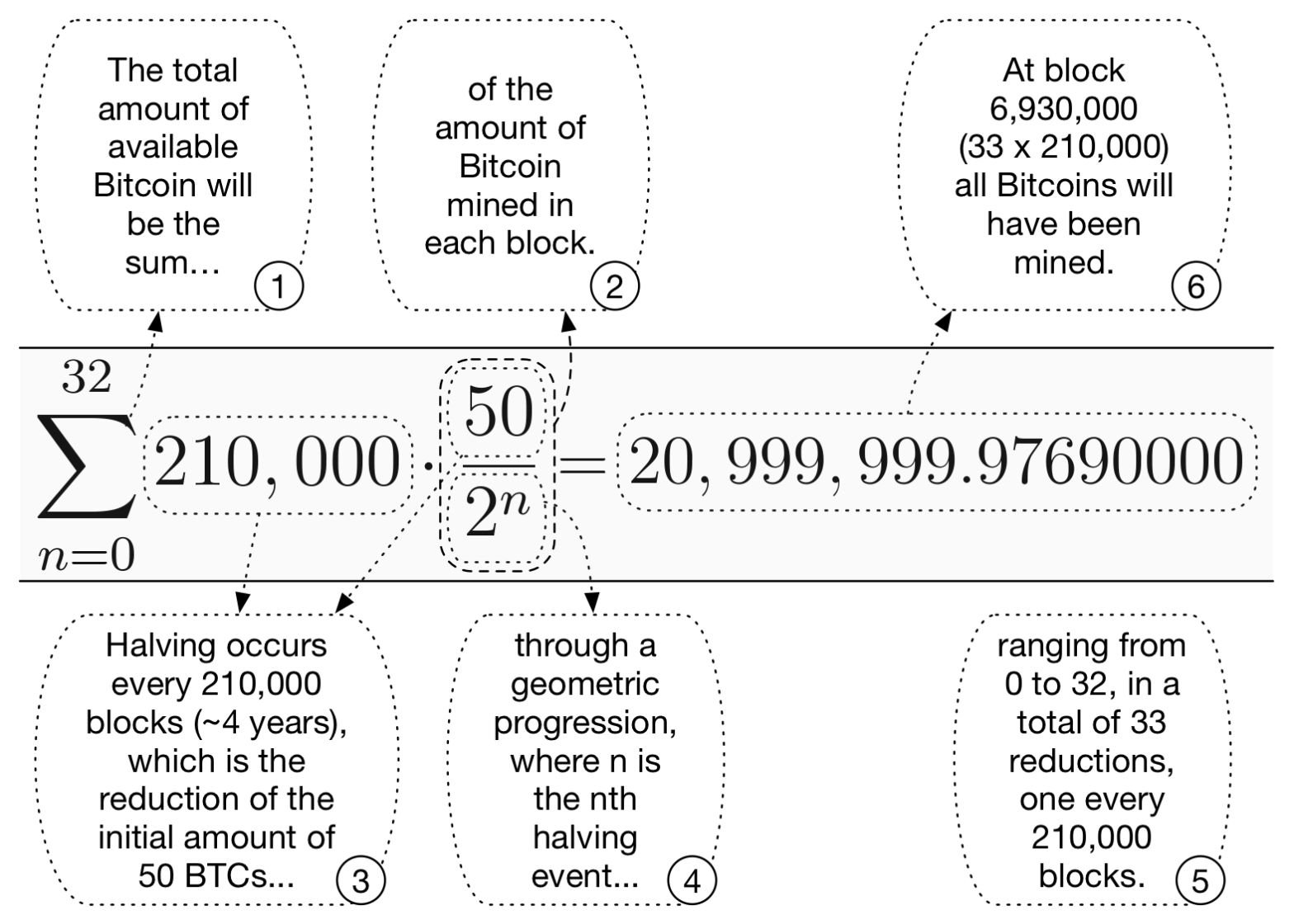

Often likened to digital gold, Bitcoin is characterized by its finite supply, with only 21 million coins ever to be in circulation.

An Introduction

In mid 2013, my professional path took a turn that would not only redefine my career but also my understanding of our financial world. As an expert involved in launching numerous prepaid card programs and retail services, I was well-versed in the intricacies of transaction processing and the daunting challenges of fraud prevention, particularly the notorious double-spend problem.

However, it was my latest assignment that set the stage for a monumental discovery – reimagining a global money transfer network. This task led me on a journey of exploration, culminating in the discovery of Bitcoin.

Skepticism Meets Innovation

I took my new assignment seriously, embarking on an exhaustive exploration of traditional and unconventional methods for global money transfers. This deep dive into financial technologies brought me to an online encounter with Bitcoin and its foundational whitepaper.

Initially, I approached Bitcoin with skepticism, a natural response given my extensive background in the payment card industry and firsthand experience in battling fraud and double-spends.

The double-spend problem, akin to a relentless game of 'whack-a-mole', seemed unsolvable. Yet, the bold claims of Bitcoin's whitepaper piqued my curiosity, for a serious financial problem, I thought would never go away.

A Revelation via Cryptography

In Bitcoin's early years, acquiring it was a far more difficult task than it is today. I successfully obtained my first portion of Bitcoin through a method known as a "bitcoin faucet," at a time when its price was only $87.50 per coin then, crazy.

Diving deep into its functionality, including wallets, mining, transactions, and security, led me to a pivotal realization: Bitcoin didn't merely suggest a theoretical fix to the double-spend problem but verifiably solved it (I really tried) using sophisticated cryptography.

This revelation marked a significant shift in my perspective, providing a viable solution to an issue that had long disrupted my work on innovative projects due to recurring fraud in card transactions.

Championing Bitcoin's Promise

Armed with this newfound knowledge and conviction, I prepared to present my findings to my employer via a very comprehensive Powerpoint presentation, that looking back predicted the future we see today and parts yet realized for tomorrow.

I chose to champion Bitcoin as the cornerstone of the reimagined global money transfer system. This was a bold move, pitching a then-obscure cryptocurrency over traditional models.

The significance of solving the double-spend problem was too monumental to ignore. It had the potential to revolutionize fraud prevention in ways I had only dreamt of in my years in the payment industry.

However, my enthusiasm was met with skepticism and dismissal. They said, "Corey, we love your enthusiasm, but we think you're crazy. Get back to work!"

The response was, to say the least, disheartening, a stark contrast to the potential I saw in Bitcoin. It appeared that I had hit another glass ceiling in my life at that time.

I was honestly not too keen on building it traditionally (like everyone else), knowing that the same ole’ same ole’ fraud vectors that I wanted to clearly avoid (given my existing knowledge) would not be any better than anything or anyone else out there. I felt I was at an impasse.

Bitcoin was already a secure Peer-to-Peer cash System with a global footprint, since it’s Genesis Block/inception. Why not just use that?

A Surprising Moment of Validation

Fast forward to November 19, 2013: Bitcoin was hoovering in the $600’s range at this point (+6.85x from when I first really started immersing myself into it at that point), I was sitting at my desk in the office during the first Bitcoin Senate hearing on C-SPAN.

A critical question was posed to FinCEN Chairman Jennifer Shasky Calvery: Does Bitcoin need regulation, Yes or No? The bazillion dollar question. Her response resonated deeply with me.

She affirmed that existing laws were adequate for Bitcoin, emphasizing its integration into the existing financial system while upholding standards like KYC, BSA, and anti-money laundering protocols.

At that moment, as her words echoed, I heard an audible voice in my head, resonating like God, Moses, or Jiminy Cricket (or something) saying:

“It’s an emergency.”

All the remaining hairs on my body immediately stood straight at attention. This profound experience marked a turning point within me, igniting a sense of urgency and purpose (as odd as it sounds).

I took it as a clear sign that I just needed to immerse myself in the Bitcoin industry to fully grasp and leverage this groundbreaking technology into the future.

Who’d ever thunk that it would be all because of Jiminy Cricket, Chairman of FinCEN Lady, The Senate, C-SPAN, and a guy named Tony’s fault, I got into bitcoin industry? funny.

A New Fintech Beginning

This moment of insight marked a significant shift in my career path. Coinciding with my nine-year anniversary at my previous job, I decided to make a change. I submitted my resignation and, in mid-2014, joined BitPay.

There, I got to engage not only with some of the regulatory aspects of the business but also immersed myself in the emerging Bitcoin community. I gained firsthand access to the technology and ecosystem.

Remarkably, Tony Gallippi, the Chairman and Co-Founder of BitPay, was also a presenter at the same pivotal & historic Senate Hearing in November that significantly altered my outlook.

This shift in perspective was largely due to FinCEN's lucid and insightful remarks on Bitcoin, which clarified the regulatory landscape — an aspect I already had a firm grasp on from my experience in payments.

This clarity and understanding not only resonated with me but also solidified my belief that Bitcoin was here to stay, making it a safe bet in my eyes.

My initiatives included integrating key merchants into BitPay’s API’s, launching their initial Crypto Masspay product, then later conceiving, creating, and implementing the very first Visa® Prepaid Card to be approved in the U.S. by Visa® , a processor, and an issuing bank that allowed for the compliant loading of U.S. dollars to a card using bitcoin in 2016, expanding The BitPay Prepaid Visa® Card to over 130 countries more a year later in 2017 (in USD, GBP & EUR underlying card currencies).

This move was more than a job change for me; it was a leap into the forefront of financial innovation, it ignited a fire in my entrepreneurial spirit, and it changed me forever.

Thanks really all goes to Satoshi Nakamoto!

Conclusion

My journey with Bitcoin, from a skeptic to an accidental innovator, is a testament to the transformative power of open-minded exploration and relentless pursuit of true solutions in fintech product development, to some of the most complex problems facing the payments industry today. Bitcoin is more than relevant.

Bitcoin, for me, is not just about global digital currency; it is the key to unlocking a future where financial transactions can be secure, transparent, and free from the age-old problem of double-spending. This is exact the kind of technology the world needs more of.

My journey is a narrative of passion, belief, and the relentless pursuit of innovation, standing as a beacon for those who dare to reimagine the pillars of our financial systems.

This odyssey, fueled by passion and a steadfast commitment to innovation, serves as an inspiration for those aiming to transform the financial sector.

It also sparked my creativity, leading to various innovations in both traditional and novel fintech products along the way.

As of posting of this article a single bitcoin is now trading at $37,479.12 (+428.3328x from when I first started really watching it at this point).

With that being said, the price does not matter, the invention of it and the problem it solves (the double-spend problem) is all that matters.

Thanks for taking the time to read my Bitcoin Genesis story. What’s yours?

Please share your bitcoin discovery story in the comments section below, sharing our stories could potentially help others understand the attributes of bitcoin that could benefit them.

Additional Resources:

Bitcoin as an electronic asset has Absolute Scarcity.

Scarcity refers to the disparity between the finite availability of various resources and the unending desires of humans.

This concept of scarcity is central to economic theory.

The intrinsic design of Bitcoin inherently guarantees an increase in its value. However, for me, the price of Bitcoin has always been of secondary importance.

What truly captivated my interest was its solution to the double-spend issue. The price is of minimal concern; it's the significance of the problem it addresses that is most crucial.

The Senate hearing referenced in the article was a critical turning point in my Bitcoin journey. It's quite ironic that it was FINCEN's stance that reassured me about pursuing a career in advancing Bitcoin adoption.

Remarkably, the regulatory framework for cryptocurrency-using companies has remained unchanged since 2013. This consistency underscores Satoshi Nakamoto's deep understanding of the regulatory environment, clearly establishing he/she/they as more than just an ordinary developer.

Ready to Elevate Your Fintech Game?

Let's Talk!

If you've enjoyed diving into the insights and innovations shared in our blog, imagine what a tailored Fintech Product Consultation could do for your business.

Schedule Your Fintech Product Consultation Session Today!

This is more than just a consultation – it's the first step towards transforming your fintech vision into reality.

Whether you're scaling up, exploring new technologies, or seeking to optimize your existing solutions, our personalized session will provide you with actionable strategies and insights.

Don't miss this chance to stay ahead in the dynamic world of fintech.