CFPB Challenges Apple’s NFC Monopoly: A Push for Competition and Consumer Choice (UPDATED 8.15.24)

In the ever-evolving world of financial technology, the spotlight is now on Apple’s exclusive control over NFC (Near Field Communication) technology in its iOS devices.

The Consumer Financial Protection Bureau (CFPB), a watchdog for consumer rights and financial practices, has raised significant concerns about Apple's restrictive NFC policies, igniting a debate on the implications for consumers and the mobile payment industry.

History of NFC Technology

NFC technology, a pivotal innovation in the field of wireless communication, traces its roots back to Radio-Frequency Identification (RFID) technology developed in the 1980s. Evolving significantly over the decades, NFC emerged as a specialized subset of RFID, designed for close-range communication.

Officially established as a standard in 2004 by Sony, Philips, and Nokia, NFC technology quickly found its way into mobile devices. Google, recognizing the potential of NFC, integrated it into Android devices in 2010, allowing developers to create a wide array of applications utilizing this technology.

In contrast, Apple introduced NFC to its iPhones in 2014, with the launch of ApplePay, which became the secret sauce behind their foray into mobile payments. While Apple did not invent the concept of 'Tap N' Pay', their approach to using NFC technology in iOS devices was distinct.

By restricting NFC use solely to ApplePay, they effectively held the mobile payments industry hostage. This exclusivity contrasted sharply with Android's open approach, where developers had the freedom to innovate with NFC, leading to a diverse ecosystem of payment and data transfer applications.

The adoption of NFC technology in smartphones during the early 2010s marked a significant milestone, leading to its widespread use in various applications, including digital wallets, access control, and information sharing.

Apple's NFC Monopoly

Apple has long held exclusive rights to the NFC technology in iOS devices, allowing only Apple Pay to utilize this 'tap and go' feature for in-store payments.

This exclusivity has limited fintech developers from making touchless applications, has been criticized by banks, other payment service providers, and regulatory bodies worldwide for creating a monopolistic environment that prevents competition from proprietary apps developed by these entities.

Why Does This Matter?

The CFPB's scrutiny of Apple’s NFC policies sheds light on a critical issue: the potential hindrance of open banking growth.

Open banking, a system where banks provide third-party financial service providers access to consumer banking, transaction, and other financial data through APIs, thrives on competition and innovation.

By restricting NFC access, Apple could be impeding the broader development and adoption of open banking solutions, potentially affecting consumer choices and experiences in the financial sector.

We could have been touchless in payments well before pre-COVID globally. This decision by Apple has honestly held the mobile payments industry back by more than a decade.

When the CFPB takes action on this matter, there will be a mobile payments revolution in fintech/banking sectors, and we will see more payment options for consumers to choose from besides just cards in the industry for consumers globally, when Apple is forced to relinquish control of the NFC antenna by the CFPB, other governing entities, and if the industry cares to speak up on the topic.

The Ripple Effect of Increased NFC Competition

If Apple were to allow other payment services access to its NFC technology, it could spur a wave of innovation, leading to enhanced services for consumers.

This change could also mean more diverse and competitive pricing models, benefiting the end user.

The CFPB suggests that Apple can still maintain its high standards for privacy and security by requiring third-party apps to meet similar criteria as ApplePay.

A Global Concern

This issue extends beyond the United States. The European Commission has charged Apple over its NFC restrictions, indicating that concerns about Apple's practices are shared globally.

This broader attention highlights the need for a cohesive approach to digital payment systems and standards, one that fosters innovation and consumer choice worldwide.

The Future of Digital Payments

The CFPB's focus on Apple's monopoly over NFC technology is more than just a regulatory concern; it's a pivotal moment in the ongoing conversation about the future of digital payments and financial services.

As we look forward, it becomes increasingly clear that the call for a more open, competitive, and innovative digital payment landscape isn't just about technology – it's about empowering consumers with more choices and better services.

The ongoing scrutiny of Apple’s NFC monopoly by entities like the CFPB and the European Commission is not just a challenge for the tech giant but a beacon for change in the digital payment space.

As we keep an eye on these developments, one thing is certain: the landscape of mobile payments is set for significant transformation, and with it, the everyday financial experiences of consumers around the globe.

The CFPB's report underscores the significant market impact of Apple's NFC restrictions. In the U.S., tap-to-pay transactions are projected to hit $179 billion in 2023, with Apple Pay being a dominant player.

The report argues that Apple's policy not only limits other firms from developing tap-to-pay apps for iOS but also hinders consumer choice and innovation.

Rethinking Security & Privacy Claims

Apple's justification for its exclusive control over NFC technology has been privacy and security. However, the CFPB challenges this claim, suggesting that Apple could mandate third-party apps to meet similar privacy and security criteria as Apple Pay, thus maintaining standards while fostering a competitive environment.

The Impact on Consumers & the Market

The CFPB emphasizes that the lack of competition in NFC technology could impede the progress towards open banking, ultimately affecting consumers negatively by reducing choices and stifling innovation.

It posits that a competitive environment where Apple competes directly with other providers could incentivize all parties to innovate and improve services.

Conclusion ( as of 3/22/24)

The CFPB's focus on Apple's NFC monopoly marks a significant step in the discussion about open access to technology and fair competition.

As the debate unfolds, it highlights the need for a balanced approach that considers consumer benefits, innovation, and the evolving landscape of mobile payments.

The outcome of this scrutiny could reshape the future of how financial services and payments are accessed and utilized by consumers worldwide.

Update 8/15/24: Apple Opens Up iPhone's NFC Chip to Developers – A New Era of Innovation Begins!

In a groundbreaking move that has sent ripples through the fintech and mobile payments industry, Apple has announced that it will finally open up its iPhone's NFC chip to developers. This monumental decision marks the beginning of a new era where innovation, competition, and consumer choice can thrive like never before.

For years, the fintech community has advocated for more open access to this critical technology, and now, the doors to innovation have swung wide open. The Consumer Financial Protection Bureau (CFPB), along with other global regulatory bodies, has played a pivotal role in this development by challenging Apple's restrictive policies. The result is a victory not just for developers and financial institutions but, most importantly, for consumers who will now have access to a broader range of touchless payment options and innovative services.

To all the builders out there: here is your moment: The landscape of mobile payments and digital finance is poised for transformation, and the opportunities are boundless. With NFC technology now accessible to all, the time to innovate is now. Whether you're a fintech startup, a developer with a vision, or a financial institution looking to push the boundaries of what's possible, this is your call to action.

Seize this moment – it's carpe diem time! The future of digital payments is in your hands, and the possibilities are limitless. Let's build a more open, competitive, and consumer-friendly financial ecosystem together.

https://www.macrumors.com/2024/08/14/apple-opening-up-iphones-nfc-chip-to-developers/

Happy Innovating Folks,

Corey

Additional Resources:

Breaking News 8.15.24

https://www.macrumors.com/2024/08/14/apple-opening-up-iphones-nfc-chip-to-developers/

Over 9 years ago, while I was with BitPay, I had the unique opportunity to observe the inaugural NFC Bitcoin transaction between a customer's wallet and a merchant. I was right there in the office, watching over the shoulder as it was recorded during one of the earliest live transactions. The experience was surreal – a cardless, touchless transaction was happening right before my eyes. It felt like a dream. But there was a notable challenge: the transaction was carried out on a Google Android device.

Apple, at that time (& even to this date), did not allow even well-established payment companies to use its NFC antenna for legitimate payment purposes. In fact back then, they did not even allow Bitcoin Wallets in their app store. Considering Apple's significant market share in smartphones, this situation perfectly illustrates why the CFPB's position is valid. Apple's restrictive policies were, and possibly still are, a hindrance to the advancement of the mobile payment sector.

Breaking News (UPDATED):

Updates on the Apple NFC Payments Global Monopoly Saga

Tech Policy Press - Under Pressure: Antitrust and Competition Authorities are Now Focusing on Apple (Published on 3/22/24): This article discusses increased antitrust and competition scrutiny on Apple by authorities.

CNBC - DOJ sues Apple over iPhone monopoly in landmark antitrust case (Published on 3/21/24): The article reports that the DOJ suing Apple over iPhone monopoly in a significant antitrust case.

CNN - Apple sued in a landmark iPhone monopoly lawsuit (Published on 3/21/24): This article describes a landmark lawsuit accusing Apple of iPhone monopoly.

CNN - Green bubbles, Apple Pay and other reasons why America says Apple is breaking the law (Published on 3/21/24): This article explores reasons behind the U.S. legal action against Apple, including Apple Pay concerns.

NY Times - U.S. Sues Apple, Accusing It of Maintaining an iPhone Monopoly (Published on 3/21/24): The lawsuit caps years of regulatory scrutiny of Apple’s wildly popular suite of devices and services, which have fueled its growth into a nearly $3 trillion public company.U.S. government accuses Apple of maintaining an iPhone monopoly.

Washington Post - Why is the government suing Apple? (Published on 3/21/24): Look at your iPhone’s restrictions. These things you can’t do with your iPhone are the heart of new allegations that Apple is an illegal monopolyDetails the U.S. lawsuit against Apple for alleged iPhone monopoly.

TechCrunch Article on DOJ's Complaint Against Apple (Published on 03/21/24): TechCrunch reported that the U.S. Department of Justice (DOJ) has filed an antitrust complaint against Apple, focusing on its control over tap-to-pay transactions through Apple Pay. The DOJ alleges that Apple's exclusive control over NFC (Near Field Communication) technology in its devices stifles competition and innovation in the payment services sector. It's argued that this monopoly leads to higher fees for banks and limits development of alternative payment services that could compete with Apple Pay. Interestingly, the report highlights that, unlike Apple, companies like Google and Samsung do not take fees on transactions made using their payment apps.

CNBC - Apple offers rivals access to mobile payment tech in EU antitrust case (Published on 1/19/24): This article covers Apple's offer to let rivals access mobile payment technology in the EU to settle an antitrust case.

TechCrunch Article on Apple's EU Pledges (Published on 1/19/24): In an effort to settle an antitrust probe by the European Union, Apple has proposed allowing third-party mobile wallet and payment service providers access to NFC functionality on iOS devices. This move aims to address concerns that Apple was unfairly favoring its own payment technology (Apple Pay) and restricting competitors. While third parties won't get access to the secure element chip used by Apple Pay, they will be given "equivalent access" via Host Card Emulation (HCE) mode. These commitments, intended to resolve the EU's antitrust charges, would be in effect for ten years if accepted.

Commission seeks feedback on commitments offered by Apple over practices related to Apple Pay (Published on 1/19/24)

The European Commission has announced a formal investigation into Apple over concerns that it may have violated EU antitrust rules. The investigation focuses on Apple's practices related to its App Store, which are suspected of limiting competition and reducing choices for consumers within the European Union. This move is part of the Commission's broader efforts to ensure fair competition and innovation in the digital market, emphasizing the importance of upholding EU regulations designed to protect both consumers and competitors.BGR Article on Apple Pay and NFC in the EU (Published on 12/12/23): BGR highlighted that Apple has offered to open its NFC chip for tap-and-go payments to competitors to settle an antitrust case with the European Commission. This would mark a significant change in how mobile payments could operate on the iPhone within the EU, breaking Apple Pay's exclusivity on the iPhone's tap-to-pay functionality. The article notes that this could potentially allow services like Samsung Pay or Google Pay to operate on iPhones in the European Union.

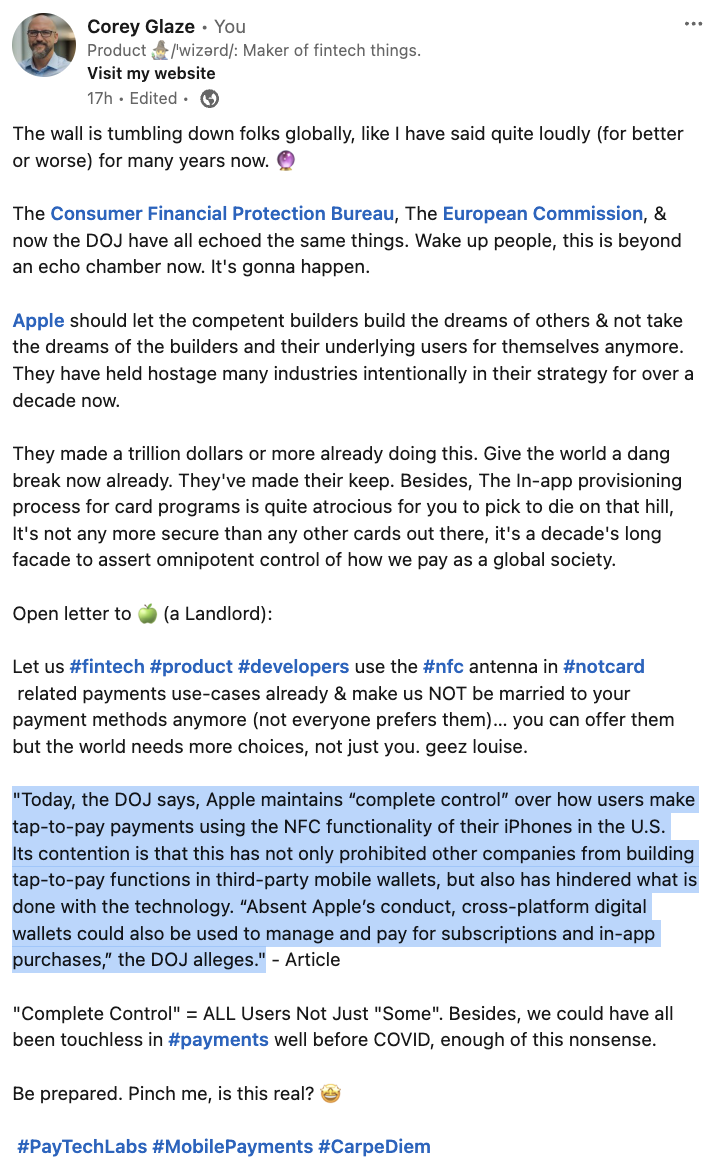

Click on the above LinkedIn Post to weigh in on this developing discussion.

Ready to Elevate Your Fintech Game?

Let's Talk!

If you've enjoyed diving into the insights and innovations shared in our blog, imagine what a tailored Fintech Product Consultation could do for your business.

Schedule Your Fintech Product Consultation Session Today!

This is more than just a consultation – it's the first step towards transforming your fintech vision into reality.

Whether you're scaling up, exploring new technologies, or seeking to optimize your existing solutions, our personalized session will provide you with actionable strategies and insights.

Don't miss this chance to stay ahead in the dynamic world of fintech.